So, you should also save money for this purpose.This template works for a weekly, biweekly, or monthly budget. You may surely require a vacation from your daily routine. Emotions play a significant part in your finances. If you are a bi-weekly employee then remember that managing your money is not only about your dollars. You can do this effectively by transferring your extra Paycheck from your checking account to your savings.

CUTE BIWEEKLY BUDGET TEMPLATE FREE

If you are free of debts then you will pay attention on your goal. Our goals are the things that keep us moving. This will assist you in reducing the temptation of dipping into the emergency saving account.

From your regular savings account, you should keep these funds a pat. It also includes a medical emergency or a lost job without necessarily requiring taking a new debt. Consider the following things with your second paycheck Make an emergency fundĪn emergency fund made for three to six months of your daily expenses tackle financial setbacks.

However, it is also important to break your routine and have time to strengthen family bonds. You have to first set aside an emergency fund with this money. Second bi-weekly Paycheck:Īfter contenting with how you have managed your first Paycheck, it’s time to plan for your second Paycheck. Furthermore, paying off a few low annual percentages rate and the low balance debt will make sure that get momentum and other financial benefits. It will save you a fortune by paying off the bills from the one with the highest rate as you will be paying bills that carry a bigger balance. By considering the annual percentage rate, you should make a list of your debts in an organized way. You should get rid of your high-rate debit that is usually your credit card debt. If you owe someone or an organization then many people are not comfortable by knowing this. But, it will reduce your anxiety as you know your first priority needs have been handled. Also, managing a bi-weekly budget is difficult. To reduce the load, consider prepaying all the utilities like foodstuff, clothing, and other basic requirements. Your rent, your mobile phone, and others are included in your bills. If you are able to prepay some bills then it is good as it will reduce anxiety in the coming months. This is important since you will be required to cater to the essential bills first. First bi-weekly Paycheck: Make a Budget plan that assumes you are paid bi-weeklyĪt first, design a budget that depends on a biweekly payment schedule. Your last option should be planning a vacation. After that, if you still have cash left, save it in emergency funds. The loans that have a high-interest rate start with them.

Moreover, the main purpose of creating a bi-weekly budget is to fulfill your basic needs. You can move to the second paycheck if your first paycheck didn’t fulfill your basic needs. With this first paycheck, you can consider your rent/mortgage, utilities, and other basic needs. After receiving your first Paycheck, the first thing that comes in mind is the basic requirements that will sustain you.

CUTE BIWEEKLY BUDGET TEMPLATE HOW TO

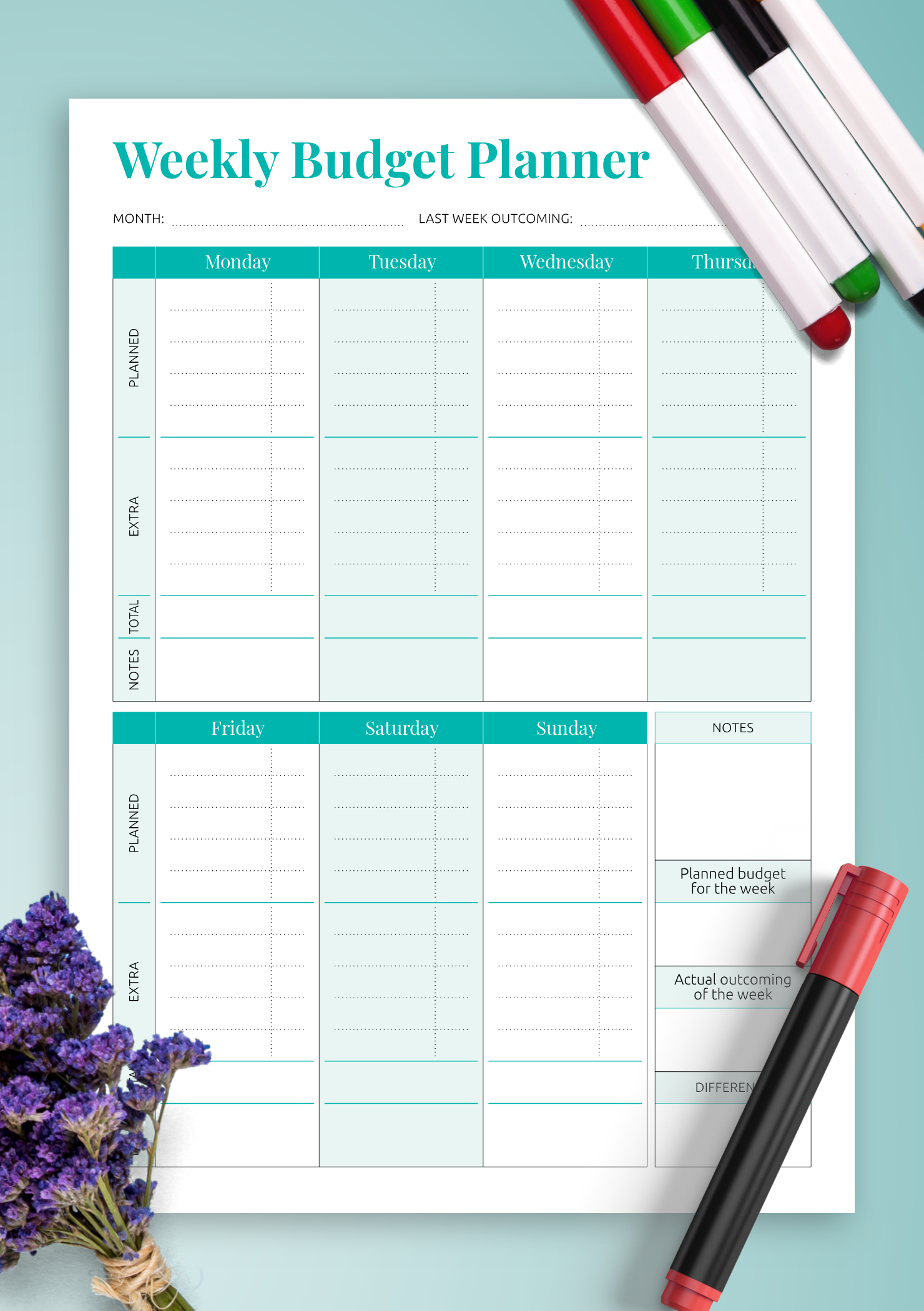

How to plan the bi-weekly budget?Ī bi-weekly budget employee gets two paychecks every month. This document is highly beneficial for an employee who receives a semi-monthly paycheck. Budgeting is necessary as it enables you whether you have extra cash to spend on items that you may find difficult to afford. A bi-weekly budget template is a helpful tool that will guide you in the right direction on managing your biweekly Paycheck.

0 kommentar(er)

0 kommentar(er)